2016 had plenty of the kind of the kinds of news-making crises that public relations people dread. It was a year of surprises, setbacks, and scandals. Here’s our list for the top stories that damaged brand reputations, wrecked careers, and kept media and PRs working overtime.

Samsung’s product recall gets heated

Samsung’s Galaxy Note 7 showed every sign of being the blockbuster it needed to challenge Apple. But shortly after its launch, the Note 7 had to be recalled after reports that the devices overheated and even caught fire. Samsung’s swift decision to pull the product at first looked smart and proactive, but things didn’t cool off. Replacement devices had to be recalled after they, too, showed defects. Worse, Samsung bungled the management of the product recalls by failing to coordinate with the Consumer Product Safety Commission. and its customer communication was slow and inconsistent. Research shows that Samsung still commands a loyal following, so the damage is likely to be temporary. The communications lessons, on the other hand, will be covered in crisis management classes for many years.

Lochte loses luster

For a 12-time medal winner, U.S. swim team star Ryan Lochte was a loser when it came to his behavior at the 2016 Olympics. His drunken vandalism of a Rio gas station might have been overlooked if he had ‘fessed up to the bad behavior, but Lochte chose to concoct a nutty, self-aggrandizing story about being robbed by gun-brandishing bandits, which particularly outraged the image-conscious Brazilians. Then he fled the country, leaving his teammates to answer to authorities. After he was busted for lying, Lochte admitted the truth and formally apologized for “not being more careful and candid.” As of December, his reputation was recovering, thanks to a crowd-pleasing turn on “Dancing With The Stars” and the announcement that he and fiancée are expecting a baby next year.

Theranos’ falls victim to its own PR

Talk about bad blood. For the once-promising biotech startup, 2016 was the year that things fell apart, following fresh repercussions from revelations that started late last year with an investigative report in The Wall Street Journal that questioned its claims. The fall of Theranos was particularly dramatic because it was in many ways a victim of its own hype. The story of a new blood-testing technology for clinicals that needed only a single drop of blood was irresistible to media, and founder Elizabeth Holmes was a PR dream. But as it turned out, many things about the secretive startup were just too good to be true. Until the Journal‘s John Carreyrou started digging, the press was too dazzled by Holmes’ youth and accomplishments to spot its flaws, and even the company’s Board of Directors, which was packed with boldface names, failed to see trouble. After Carreyrou filed 12 more stories about Theranos in 2016, it became the target of criminal and civil investigations by the Securities and Exchange Commission. The ultimate account of the insider who blew the whistle on the company is riveting – part suspense novel, part Shakespearean tragedy.

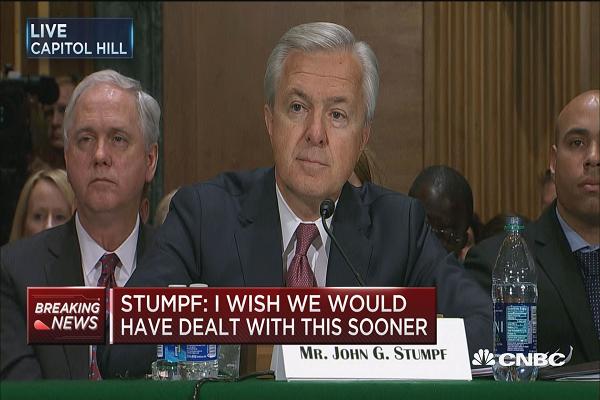

Wells Fargo’s phony accounts exposed

After it came to light that millions of fake customer accounts were set up by Wells Fargo staff to pad their sales figures, the bank agreed to pay $185 million to settle claims, and CEO John Stumpf apologized and vowed to do better. But Stumpf at first seemed to blame rank-and-file employees, 5300 of whom were fired over the scandal. He then shifted gears and communicated his own sense of accountability for the situation, telling members of the Senate Banking Committee, “I accept full responsibility for all unethical sales practices in our retail banking business, and I am fully committed to doing everything possible to fix this issue, strengthen our culture, and take the necessary actions to restore our customers’ trust.” That was the right move, but for Stumpf, it was a case of too little, too late. He retired in October, and Wells Fargo is still grappling with the reputation impact.

EpiPen price causes outrage

Move over, Martin Shkreli! Heather Bresch, CEO of pharmaceutical company Mylan, became the poster child for industry greed in 2016. After public outrage over Mylan’s 400% price increases for its flagship product EpiPen, Congress launched an investigation, and it wasn’t satisfied with Bresch’s answers. Mylan swiftly responded to the crisis with favorable pricing for those without adequate health insurance, and a plan to launch a generic version of EpiPen, but the backlash continues. Mylan’s stock has dropped from $54 at the beginning of the year to $36.60.

Vulgar comments on a bus nearly derail the Trump train

Beware the hot mike. The lewd boasts that Donald Trump made 11 years ago during a taping of “Access Hollywood” were probably the biggest reputation story of 2016, and that’s saying something. When Trump bragged about kissing and grabbing women without their consent, it sparked a national reaction and for a few days at least, threatened to derail some key endorsements. But the Trump campaign insisted it was “locker room talk” and responded with help from a team of surrogates and a (perfunctory and defensive) video apology by Trump. In a second wave of crisis response likely devised by Steve Bannon, it counterattacked by dredging up Bill Clinton’s sexual history. We all know how the story ended.

NC business goes down the drain with “Bathroom Bill”

When North Carolina Governor Pat McCrory signed HB2 – legislation to regulate use of public facilities by transgender individuals, he unleashed a torrent of controversy – and ultimately, his own electoral defeat by one of the slimmest margins in history. The governor tried to frame the “Bathroom Bill” as protecting individual privacy, but a coalition of LGBTQ rights groups and big business, including major technology companies, eventually prevailed against the spirit of the law. HB2 gave rise to serious and prolonged economic boycott of the state by major corporations and sports organizations, flushing away an estimated $600 million in revenue. McCrory’s narrow defeat helped clear a path to the bill’s repeal or modification.

Email hack bedevils Democrats

The Democratic National Committee grappled with its own surprise leak earlier in the summer of 2016 when private emails became public. The DNC moved quickly to limit the damage; Chairwoman Deborah Wasserman Schultz and other key party officers promptly resigned in the wake of the scandal. But the problems for other Democrats were just beginning. Clinton campaign director John Podesta’s emails were obtained by Russian hackers and released by Wikileaks, and although the material lacked a bombshell, the slow drip of embarrassing material was a repeatedly picked up by the press. It distracted the Clinton team from its message and placed it in an awkward position when questioned about the resulting material. All in all, the hacks were a reminder to all of us that employee behavior needs to adapt to the security risks we all run every day.

Fake news is big news

Fake news made some of the biggest headlines in 2016. The many false stories that went viral leading up to the election fueled concerns that we’re entering a “post-factual” era when trust in legitimate media will only decline. The good news is that some of the smartest technology and journalism minds are working together to offer solutions. First, Google and Facebook announced they won’t support the ad technology for fake news sites, and Facebook has said it’s devising a range of countermeasures to flag false articles. More recently, Upworthy ‘s Eli Pariser and others have started The Truth Project, which is looking at Chrome extensions, fake-news-blocking-apps and even blockchain technology to rid us of the fake news plague.

An earlier version of this post ran on MengBlend.